Execution of Lien & Deed Processing

Execution of Lien & Deed Processing

Liens are configured and posted through the Lien Processing menu, where each step in the process is structured by levels within the Lien Process Master.

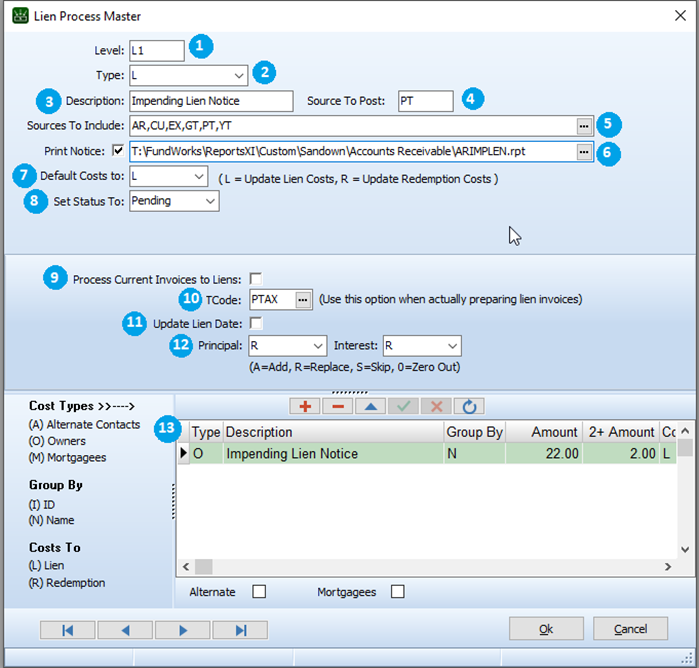

Lien Process Master

1. Level to be Processed:The lien process is divided into distinct levels to identify each stage:· L1- Notice of Impending Lien· L2- Executing the Lien· L3- Notice of Impending Deed· L4- Executing the Deed· MC- Assigning Mortgage Search CostsNote: Verify notice costs with the tax collector association each year, as they may change.2. Type – Specify the type for the current stage:· Select 'Lien' for Notice of Impending Lien and Lien Posting.· Select 'Deed' for Notice of Impending Deed and Deed Posting.· Select 'Redemption' for Redemption Costs.Lien Process Master (contd.)

1. Level to be Processed:The lien process is divided into distinct levels to identify each stage:· L1- Notice of Impending Lien· L2- Executing the Lien· L3- Notice of Impending Deed· L4- Executing the Deed· MC- Assigning Mortgage Search CostsNote: Verify notice costs with the tax collector association each year, as they may change.2. Type – Specify the type for the current stage:· Select 'Lien' for Notice of Impending Lien and Lien Posting.· Select 'Deed' for Notice of Impending Deed and Deed Posting.· Select 'Redemption' for Redemption Costs.Lien Process Master (contd.)

3. Level description: Description of the level.4. Revenue Source to Post: Designate the revenue source.5. Revenue Sources to include: Click the ellipsis (…) to select the applicable revenue sources.6. Print Notice (Optional): Enter a default notice report if desired. Checking this box will automatically print the notice when processing.7. Default Costs to: Designate costs for Liens (L1 & L2) or Redemption (L3 & L4).8. Set Status To: Defaulted option based on Level selection. Pending: L1, Lien: L2 & L3, and Deed: L4.9. Process Current Invoices to Liens: Only check this box when setting up posting parameters. If checked, the current invoices will be liquidated.10. Tcode: This code tells FundWorks what GL accounts are to be used upon posting.11. Update Lien Date: When checked, this will set the new lien invoice date to match the posting date.12. Principal & Interest: Specify how to manage principal and interest:· (A) Add· (R) Replace· (S) Skip· (0) Zero out13. Notice Costs: Enter the type of cost (A) Alternate Contact, (O) Owner, or (M) Mortgagee. Choose to group by property ID or owner name and enter costs for single parcels and subsequent parcels.Note: Additional configuration parameters are required when executing the deed.

14. Process Current Liens to Deeds: Only check this when setting up posting parameters. If checked, all outstanding invoices will be liquidated.15. Use Lien TCode: When checked, the GL account numbers associated with the lien Tcode will be used. You can find these GL account numbers in the Administration Module by navigating to AR > Transaction Code Master. Select the Lien Tcode, edit the record, and then click on the Distribution tab.If unchecked, the original invoice Tcode is used.16. Update Deed Date: When checked, the deed date will be set to match the posting date.

Execution of Liens & Deeds

1. Prepare Liens & Print Notification: Level Two (L2) or Level Four (L4)

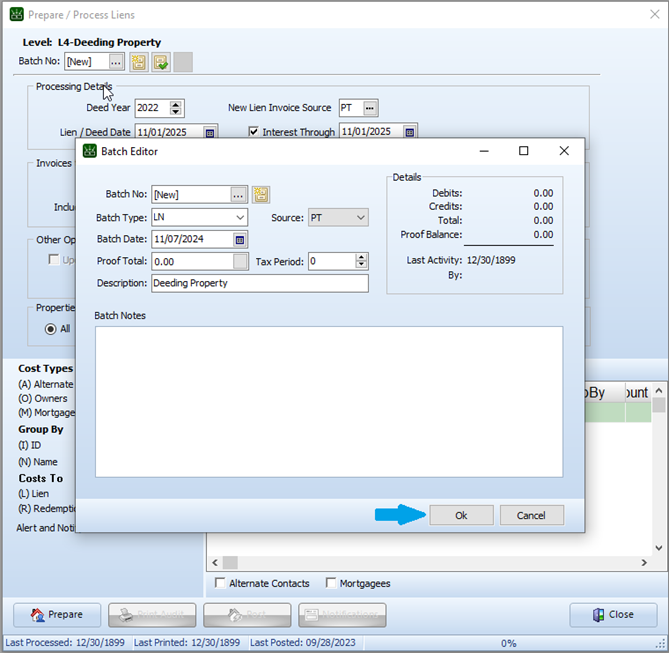

2. Select Level Two or Level Four to prepare for execution.

1. Batch No: All processing now occurs within a batch, regardless of the level being processed.2. Tax Year: Enter the tax year to be liened.3. New Lien Invoice Source: Enter the source for posting liens.4. Lien/Deed Date: Enter the date for posting liens (not the notification date).5. Interest Through: The Interest Through date will automatically populate with the Lien/Deed date entered.6. Invoices to Process- Sources: Confirm the revenue sources to include (pre-populated from Lien Process Master but adjustable here).7. Invoices to Process-Include Invoice From: This will automatically default based on the selected Tax Year.8. With balances over: When selecting the invoices that will be considered for lien, you can specify a minimum balance.**Important** this balance is a cumulative minimum for the property and tax year.9. Other Options: To update AR Lien Name/ID records from the assessing import, check the designated box. Additional reporting sources can also be included in the lien preparation process.10. Properties to Process: Choose to process all properties or a specific parcel (by selecting and entering the parcel ID).11. Applicable Costs: Confirm and, if needed, adjust notice costs in the Lien Process Master.12. Prepare: Once all selections are entered, click Prepare to initiate Batch Editor Screen. The user can select which properties to lien during the preparation process.13. Batch creation screen allows the user to use an existing lien batch or create a new batch and Click OK.

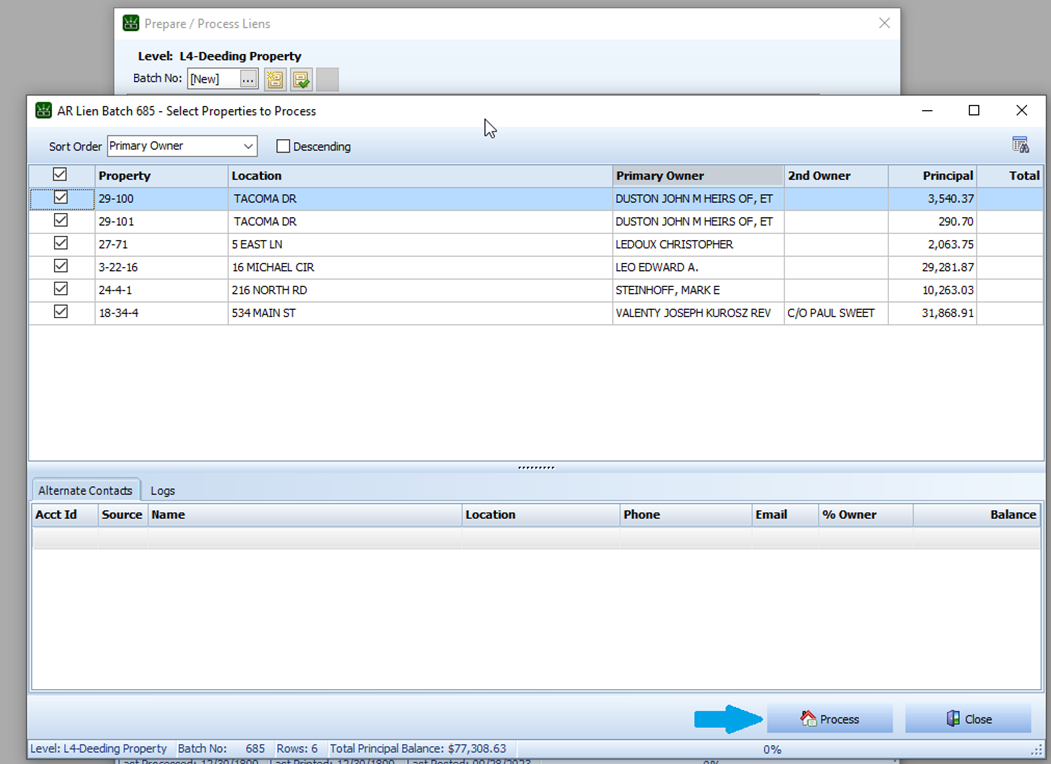

14. The new AR Lien Batch window will open, displaying all eligible properties with checkboxes pre-selected. To exclude any property from the lien process, simply uncheck the box to the left of the property’s entry. This action will remove it from the batch and ensure it is not included in the lien processing.15. With all properties to be included marked, click the Process button in the lower left-hand corner of the screen to continue with the remainder of the lien notification process.

14. The new AR Lien Batch window will open, displaying all eligible properties with checkboxes pre-selected. To exclude any property from the lien process, simply uncheck the box to the left of the property’s entry. This action will remove it from the batch and ensure it is not included in the lien processing.15. With all properties to be included marked, click the Process button in the lower left-hand corner of the screen to continue with the remainder of the lien notification process.

16. Once the progress bar reaches 100%, Click Close and proceed to Print Audit report.17. Once the lien level has been prepared you will have the opportunity to Print Audit report.

16. Once the progress bar reaches 100%, Click Close and proceed to Print Audit report.17. Once the lien level has been prepared you will have the opportunity to Print Audit report.

18. Report Name: ARLienPrePostAudit.rpt. Two distinct levels to print the report in: Detailed or Summary.19. After printing the report, it is important to Post the batch. Click Post. Please verify the batch number and check the Eb2Gov checkbox to synchronize the lien invoices to Eb2Gov.

20. Click Yes. Once the batch is posted. You will receive confirmation that the level processed has been posted.

21. After the execution of Liens and Deeds is posted, proceed to generating a Treasurers Report and generating an Affidavit of Lien & Registry report, if required.

Affidavit of Lien & Registry Report1. Lien Processing > Lien Reports > Full Reports

1. Status = Liened2. Level = All3. Dates = Select Lien and enter Lien date for all 3 dates4. Tax Year being liened5. Source = All6. Sort Order preference7. Click Print8. Affidavit Report Name: ARLNRPT.rpt9. Registry Report Name: ARLienRegistry.rptLien Maintenance

Lien Processing Menu > Lien Maintenance

The lien master contains a list of all pending, posted and redeemed liens. It is accessed via the Lien Maintenance option.

1. At the top of the screen, you can sort it by name, property ID, or location, and filter by Status and Tax Year.2. To display a specific property, enter a specific property, name, or location, select the Filter checkbox, and click the Refresh button.3. The Batch field allows users to view a specific processed batch for Liens or Deeds.4. The lower portion of the display shows each stage of the lien process related to the selected property.

Lien RecordTo access Lien Record, open the Lien Maintenance window and either click the Edit icon (pencil and paper), right-click on the property or double click the record.The Lien Record displays key details, including:

Lien HistoryTo delete lien history, right-click within the corresponding tab in Lien Maintenance and select the delete option from the submenu. The total costs on the lien record will automatically update to reflect the deleted entry.Lien AuditLien maintenance records now feature an audit log detailing any liquidations that have taken place. This allows you to instantly view the transactions contributing to a new lien or deed invoice. The audit includes filters, enabling you to easily focus on specific transaction types, tax years, or levels as needed.For inquiries, please reach out to us at support@interwaredev.com. You can also call us at (877) 357-7100. If you're calling from within New Hampshire, dial 603-673-7155. For assistance with FundWorks, press 2 when prompted.

Related Articles

Processing Abatements

FundWorks Accounts Receivable – Processing Abatements Processing Abatements Abatements are generated, printed and posted from the Adjustments Menu. Step 1: Adjustments > Enter Adjustment Memos Step 2: Invoices will appear in black and may be abated ...Processing Refunds

FundWorks Accounts Receivable – Processing Refunds Follow the steps below to process a refund in the FWAR module. 1. Open the Adjustments Section From the menu, navigate to: Adjustments → Enter Adjustment Memos 2. Locate the Property Record Search ...Impending Liens & Deeds

FundWorks Accounts Receivable – Impending Liens & Deeds Impending Lien & Deed Processing Liens are configured and posted through the Lien Processing menu, where each step in the process is structured by levels within the Lien Process Master. Lien ...Mortgagee Search & Notice Costs

FundWorks Accounts Receivable – Mortgagee Search & Notice Costs Mortgagee Search & Notice Costs Mortgage Search & Notice costs are configured and posted through the Lien Processing menu, where each step in the process is structured by levels within ...Updated: MS-61 Report Guide

FundWorks Accounts Receivable –MS-61 Report Guide MS-61 Report Guide Purpose: This guide helps you gather the data needed for the MS-61 Annual Report, which is submitted to the State of New Hampshire as part of your property tax reporting ...